LTC Price Prediction: Targeting $115-120 by October 2025 Amid Mixed Signals

#LTC

- LTC is testing key support at $105.48 with current price at $110.17

- Mixed technical signals show mild bearish momentum but potential for rebound

- Market sentiment remains positive with $115-120 October target despite headwinds

LTC Price Prediction

Technical Analysis: LTC Shows Mixed Signals Near Key Support

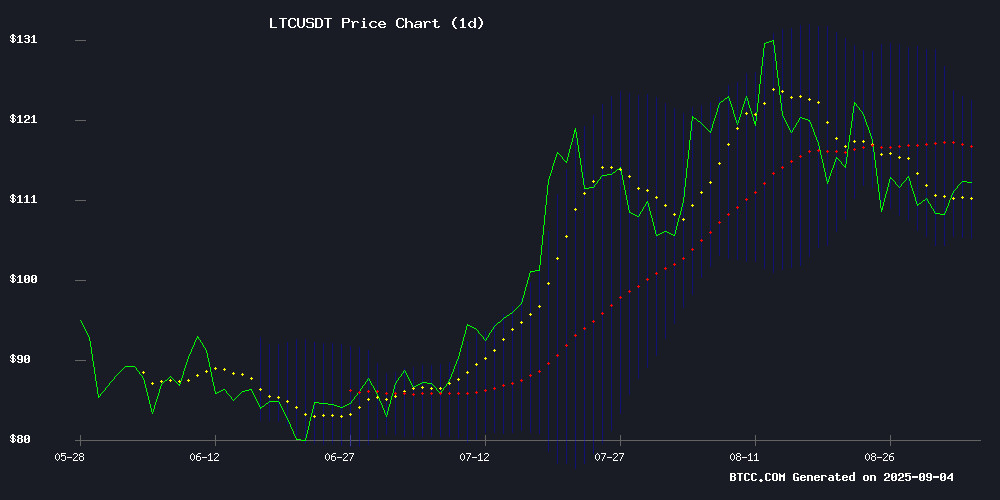

Litecoin is currently trading at $110.17, slightly below its 20-day moving average of $114.37, indicating potential short-term weakness. The MACD reading of -0.0718 suggests mild bearish momentum, though the histogram remains relatively flat. According to BTCC financial analyst James, 'LTC is testing crucial support at the lower Bollinger Band of $105.48. A hold above this level could pave the way for a rebound toward the middle band at $114.37.' The Bollinger Bands show moderate volatility with the upper band at $123.25, providing a near-term resistance target if bullish momentum returns.

Market Sentiment: Litecoin Defies Headwinds with Resilience

Despite broader market challenges, Litecoin maintains strength above $111, supported by positive ecosystem developments and growing meme coin enthusiasm. BTCC financial analyst James notes, 'The ongoing debate between XRP and LTC communities highlights Litecoin's enduring relevance, while Polygon's performance and BlockDAG's market attention create a favorable backdrop for LTC.' News headlines suggest increasing confidence, with price targets of $115-120 by October 2025 reflecting optimistic medium-term expectations. However, this sentiment aligns with technical caution, emphasizing the need to watch key support levels.

Factors Influencing LTC's Price

From Doge to Maxi Doge: Why Meme Coins Are Getting Louder, Fitter and Wilder in 2025

Dogecoin (DOGE), launched in 2013 as a Litecoin fork, has evolved from an internet joke to a cultural phenomenon. Its unlimited supply and Shiba Inu mascot belied a growing global community that turned it into a liquid asset with staying power. By 2025, DOGE's paradox is clear: it thrives precisely because it never pretended to be serious money.

Corporate experiments now test DOGE's boundaries. CleanCore Solutions' attempt to adopt a Dogecoin treasury model—backed by a $175 million private placement—triggered a 59% stock plunge. The market's rejection underscores the tension between meme coin culture and institutional frameworks. Yet the move signals DOGE's maturation from joke to speculative reserve asset.

The House of Doge partnership with 21Shares exemplifies this shift. Like bitcoin before it, DOGE is becoming a stress test for how traditional finance absorbs internet-native assets. Its volatility remains extreme, but the coin's persistence suggests meme economics may have staying power beyond hype cycles.

Polygon and Litecoin Show Strength as BlockDAG Gains Market Attention

Polygon (POL) has surged 14% this week, reaching $0.27 amid rising trading volume and open interest. The token now faces a critical resistance level at $0.29, with analysts noting a breakout from a symmetrical triangle pattern—a bullish technical signal.

Litecoin (LTC) continues to hold its $108 support level, demonstrating resilience despite broader market volatility. Traders are watching for a potential rebound or breakdown at this key price floor.

BlockDAG emerges as the market's new focal point, with miner shipments underway and a $396 million presale underscoring strong investor confidence. Its ecosystem development is increasingly viewed as one of the most promising narratives for 2025, combining tangible progress with transparent execution.

Ripple CTO Claps Back at Litecoin Influencer in Viral XRP vs. LTC Debate

The cryptocurrency community is abuzz after a heated exchange between Ripple CTO David Schwartz and Litecoin influencer @jonnylitecoin reignited debates over XRP and LTC. The clash centered on proof-of-work versus pre-mined tokens, with Schwartz defending XRP's energy efficiency as a long-term advantage.

@jonnylitecoin opened fire by questioning XRP's real-world utility, calling it a "psychological operation" without visible blockchain activity. The influencer contrasted this with Litecoin's proof-of-work model, arguing mining creates inherent value through energy expenditure.

Schwartz countered with an economic argument: "Two products are equivalent except that one takes much more energy to make than the other. Which one do you think is the most likely to grow in popularity over time?" The retort reframed the debate around sustainability rather than creation methodology.

Litecoin (LTC) Holds Above $111 Despite Market Headwinds - Key Support Levels in Focus

Litecoin's price resilience at $111.16 (-0.33% in 24h) defies broader crypto market volatility, with technical indicators painting a neutral picture. The RSI at 46.47 hints at potential momentum reversal, while the network's robust activity—340M+ transactions processed, including 12% in 2025 alone—underscores fundamental strength.

Recent price pressure, sliding from $113.75 on August 28, mirrors sector-wide sentiment rather than LTC-specific weakness. This divergence between price action and on-chain utility often signals accumulation opportunities for astute traders.

LTC Price Prediction: Targeting $115-120 by October 2025 Despite Mixed Technical Signals

Litecoin faces a pivotal moment as it trades at $112.63, caught between conflicting technical indicators. Analysts diverge sharply on its trajectory, with conservative targets near $115 and ambitious projections reaching $368. The cryptocurrency must break through immediate resistance at $124.77 to validate bullish scenarios.

Short-term technical analysis suggests an 8-12% upside potential to the $120-125 range within 4-6 weeks. Market structure remains the critical factor—either confirming the current resistance levels or breaking toward higher valuations. Support holds firm at $106.38, with stronger footing at $95.32 should bearish momentum prevail.

How High Will LTC Price Go?

Based on current technical indicators and market sentiment, LTC could reach $115-120 by October 2025 if it holds above key support levels. The following table summarizes critical data points:

| Metric | Value | Implication |

|---|---|---|

| Current Price | $110.17 | Below 20-day MA, testing support |

| 20-day MA | $114.37 | Near-term resistance level |

| Bollinger Lower Band | $105.48 | Crucial support to hold |

| MACD Signal | -0.0718 | Mild bearish momentum |

BTCC financial analyst James emphasizes that 'LTC's ability to maintain above $105.48 will be decisive. A breakout above $114.37 could accelerate movement toward $120.'